- The identified engines of human betterment are personal and impersonal exchange systems.

- Rule-governed freedom of choice in markets allows human social and economic systems to explore and discover new opportunities for specialization and innovation through gains from exchange.

- Personal exchange systems built on trust preceded and complement markets. Both share the ancient principle of mutual giving and receiving.

- In social systems rules emerge from cultural experience and become the basis for property rights—the rule of law—in market exchange.

- “Know-how” is widely distributed. Therefore, efficient coordination of individual choice depends on rules that respect limited resources and the rights of others.

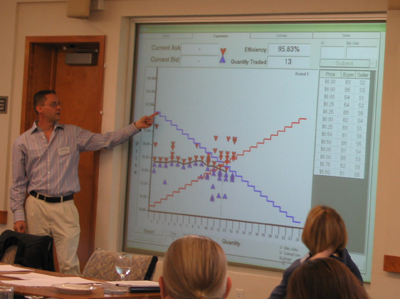

- Market experiments enable us to better understand how institutions, rules and individual motivation matter in human economic betterment.

- The critical distinction between the 2 kinds of markets, flow markets and asset markets, is important.

- Non-durable final product and service markets have been found to be effective under much weaker information conditions than standard economic theory had predicted. In laboratory market experiments, dispersed private information is sufficient for stable performance in these final goods markets.

- Laboratory experiments in trading assets—long-lived durables—have yielded unexpected bubbles, exacerbated by money and credit. These challenges to rational expectations theory appear to have strong parallels in housing and financial intermediary market.

- Markets can be structured so that they are self-regulating and self-ordering to create new long-term value, but the structure of (property) rights to take action must honor technical features that vary across different industries and physical environments.

- This structure requires “test bedding” (try it before you fly it) in both the laboratory and the field to understand new applications. A particular challenge is to find rules that improve stability in asset market environments consistent with their essential contribution to wealth creation.